Navigating the world of Provident Fund (PF) withdrawals can sometimes feel like deciphering a new language. Among the key terms you’ll encounter are “Form 19” and “Form 10C.” These aren’t interchangeable codes; they serve distinct purposes, acting as specific keys to unlock different portions of your PF savings. Understanding when to use each form is crucial for a smooth and successful withdrawal process. Consider this your Rosetta Stone, clearly distinguishing between Form 19 and Form 10C and guiding you towards the right form for your needs

Decoding the Forms: Purpose and Key Differences

Instead of a dry comparison, let’s understand the core function of each form:

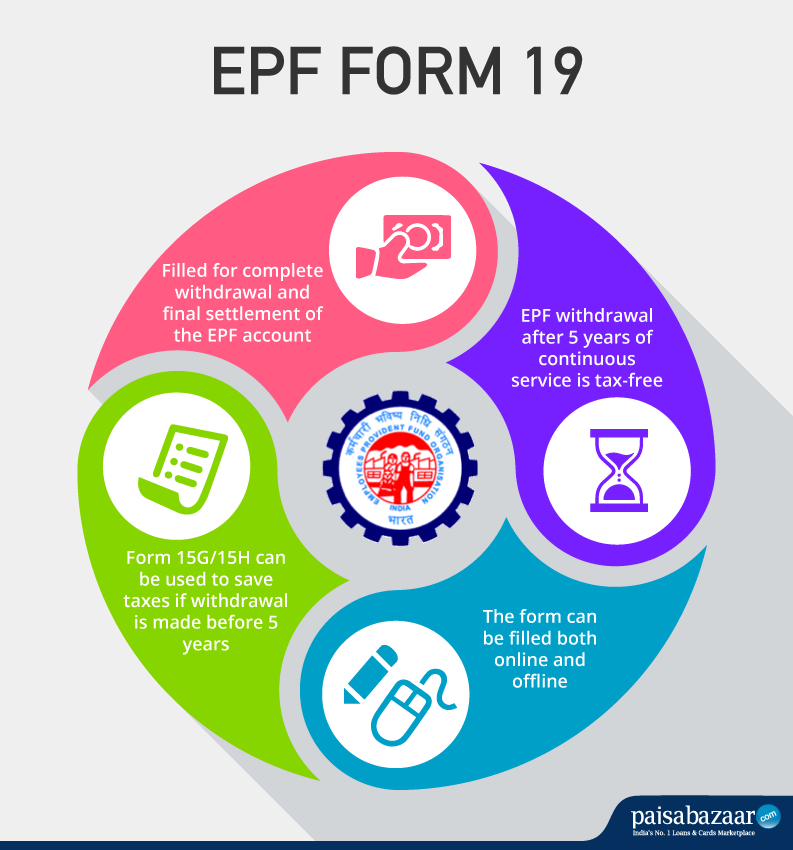

- Form 19: The Exit Strategy for Your PF Corpus. Think of Form 19 as your primary exit ticket for your accumulated PF balance – the total contributions made by you and your employer, along with the interest earned. This form is typically used for the final settlement of your PF account when you leave service (after meeting certain criteria, such as a waiting period post-employment). It’s about accessing the entirety of your PF savings.

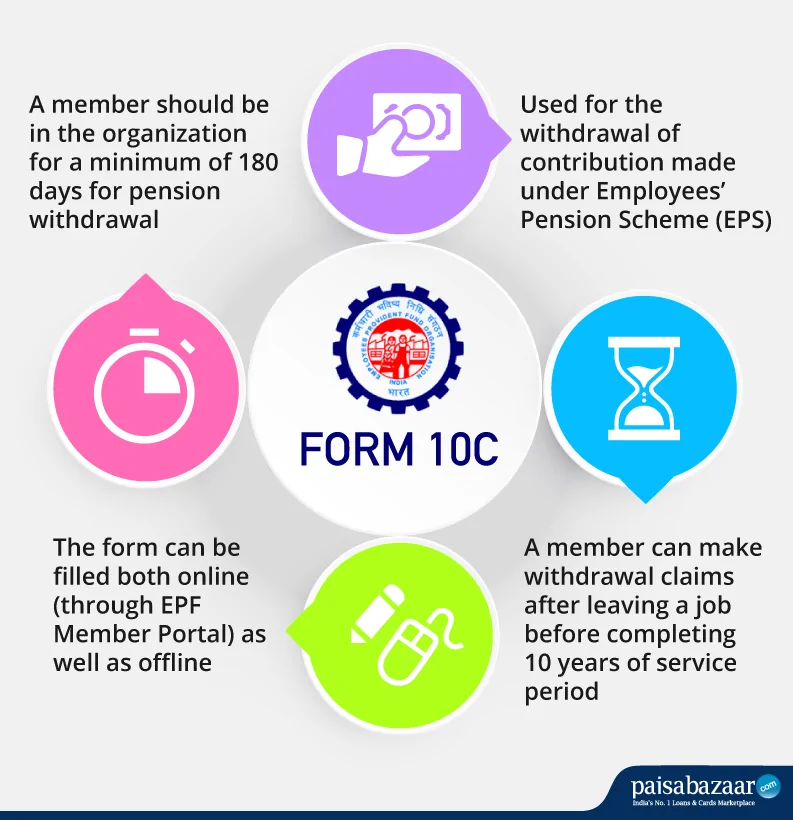

- Form 10C: Your Gateway to Pension Benefits. Form 10C, on the other hand, specifically addresses the Employees’ Pension Scheme (EPS) component of your PF. A portion of your and your employer’s contribution goes towards this pension fund. Form 10C is used to either withdraw the accumulated pension amount (if your total service period is less than 10 years) or to obtain a Scheme Certificate (if your service is more than 10 years but you haven’t reached retirement age), which allows you to carry forward your pensionable service to a new employer. It’s about managing your pension benefits, separate from the main PF corpus.

Here’s a table summarizing the key distinctions:

| Feature | Form 19 (PF Withdrawal) | Form 10C (Pension Withdrawal/Scheme Certificate) |

|---|---|---|

| Primary Goal | Final withdrawal of PF balance | Withdrawal of EPS amount or Scheme Certificate |

| When to Use | Upon leaving service (after eligibility) | Upon leaving service (based on service years) |

| Focus | Entire PF contribution + interest | Only the pension component (EPS) |

| Outcome | Lump-sum PF withdrawal into your bank account | Lump-sum EPS withdrawal or Pension Certificate |

Export to Sheets

Navigating Your Needs: When to Choose Which Form

The key to selecting the right form lies in your specific situation and what part of your PF you intend to access:

- Use Form 19 if:

- You have left service and are eligible for the final settlement of your PF account.

- You wish to withdraw the total accumulated amount in your PF account (employee and employer contributions + interest).

- Use Form 10C if:

- You have left service and your total service period is less than 10 years, and you wish to withdraw the accumulated amount in your EPS account.

- You have completed more than 10 years of service but haven’t reached 58 years of age, and you want to obtain a Scheme Certificate to carry forward your pensionable service.

Important Note: Often, when applying for the final settlement after leaving a job and having less than 10 years of service, you might need to fill both Form 19 and Form 10C to withdraw your full PF balance (excluding any amount that might be non-withdrawable as per the rules). The online portal often streamlines this process, allowing you to submit both claims together. For offline submissions, you might need to fill separate forms or the Composite Claim Form which combines these.

Your Path to Clarity: Ensuring a Smooth Process

Understanding the difference between Form 19 and Form 10C empowers you to initiate the correct withdrawal process. Always ensure your KYC details are updated and verified on the

Final Thoughts

Form 19 and Form 10C are distinct tools in your PF withdrawal toolkit, each serving a specific purpose in accessing your retirement savings. By understanding their differences and knowing when to apply for each, you can navigate the process with greater clarity and ensure you’re unlocking the right part of your hard-earned financial future.

A guiding principle for your PF access:

“Know your forms, understand their purpose, and unlock your savings with informed action.”